Sponsored Article

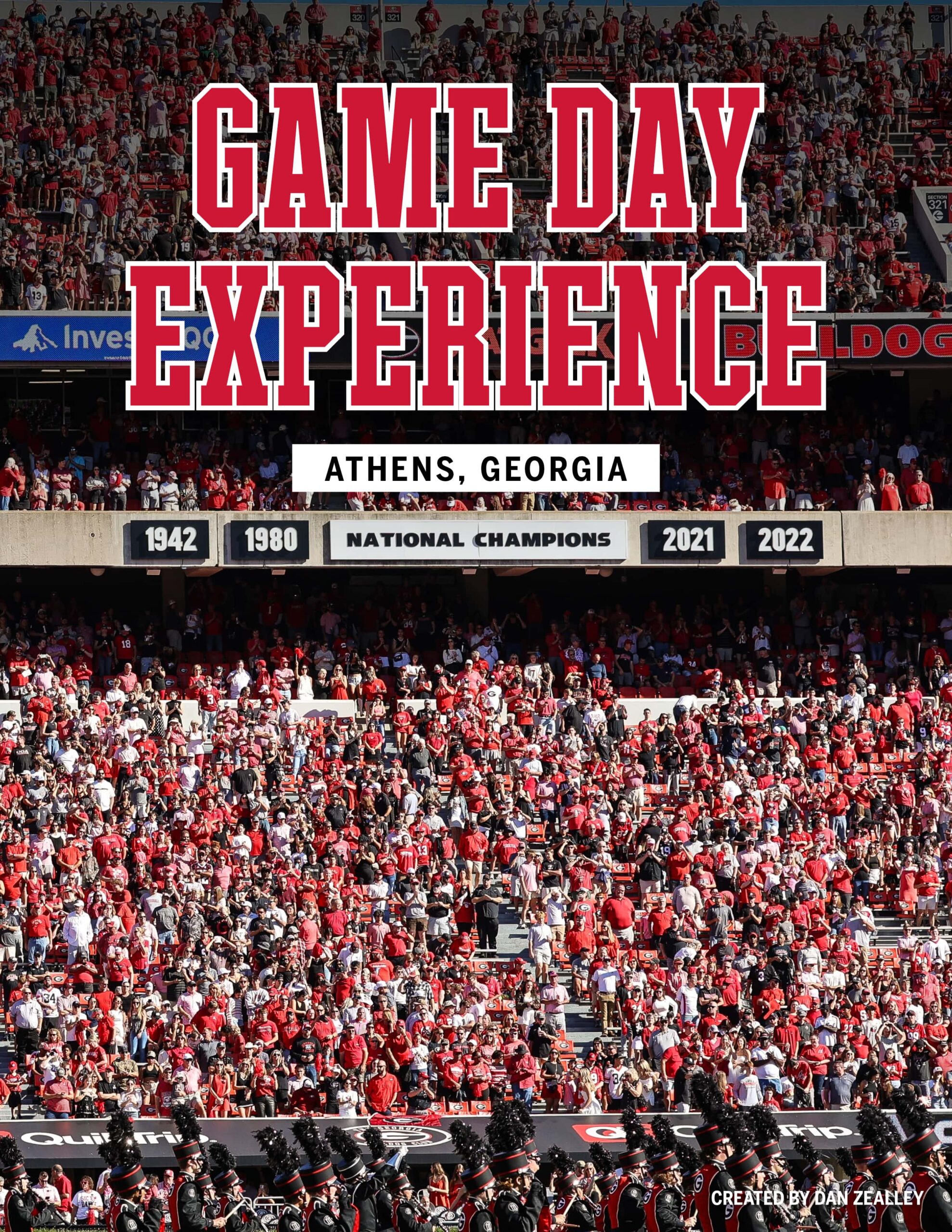

“Game Day Experience: Athens, Georgia”. This 120-page, color, hard-cover photo book will include Athens, UGA, all athletics, football, and game day tailgate/game photos. Click here for more information.

By Dan Zealley

Georgia Senate Bill 71, introduced by five Georgia state senators, would make college athletes exempt

for having to pay state taxes according to On3 Sports.

A new Georgia state Senate bill would exempt NIL compensation received by college athletes from the state income tax if passed.

Georgia institutions are already allowed to pay athletes directly for NIL.

More: https://t.co/odB95jX1FG pic.twitter.com/v7oOJwsrXf

— On3 NIL (@On3NIL) February 4, 2025

The current Georgia state tax rate is 5.39%. Players from SEC teams in states like Florida, Tennessee,

and Texas pay no state taxes. If a player at a university in Georgia signs a Name, Image, and Likeness

(NIL) deal for $1 million, they pay $53,900 in state taxes.

More Sports News

This past September. Georgia Gov. Brian Kemp (a University of Georgia grad) signed an executive order

to prevent the NCAA from taking “adverse action” against a state institution for directly compensating

an athlete. In recent years, lawmakers in Missouri and Texas have passed bills to prevent the NCAA

from launching investigations into NIL activities.

Brandon Beach was one of the senators to introduce the bill. “Listen, recruiting is a very, very

competitive sport,” Beach told the Athens Banner-Herald on Tuesday. “When you’re recruiting these

five-star athletes, they all have agents and we’re competing with Tennessee, Texas and Florida who

have no state income tax.

Many took to social media to express dissatisfaction with the idea of athletes being exempt from state

taxes. “They need to pay taxes on that income the same as I have to.” One wrote. Another added “Why

will millionaire athletes get special treatment?”

If this bill does get passed, Georgia and Georgia Tech will enjoy a competitive recruiting advantage over

schools in other states that have state income tax on NIL deals.